washington estate tax return due date

Here you can check your filing due dates to make sure your tax return gets in on time. Tuesday May 26 2020.

Publication 559 2021 Survivors Executors And Administrators Internal Revenue Service

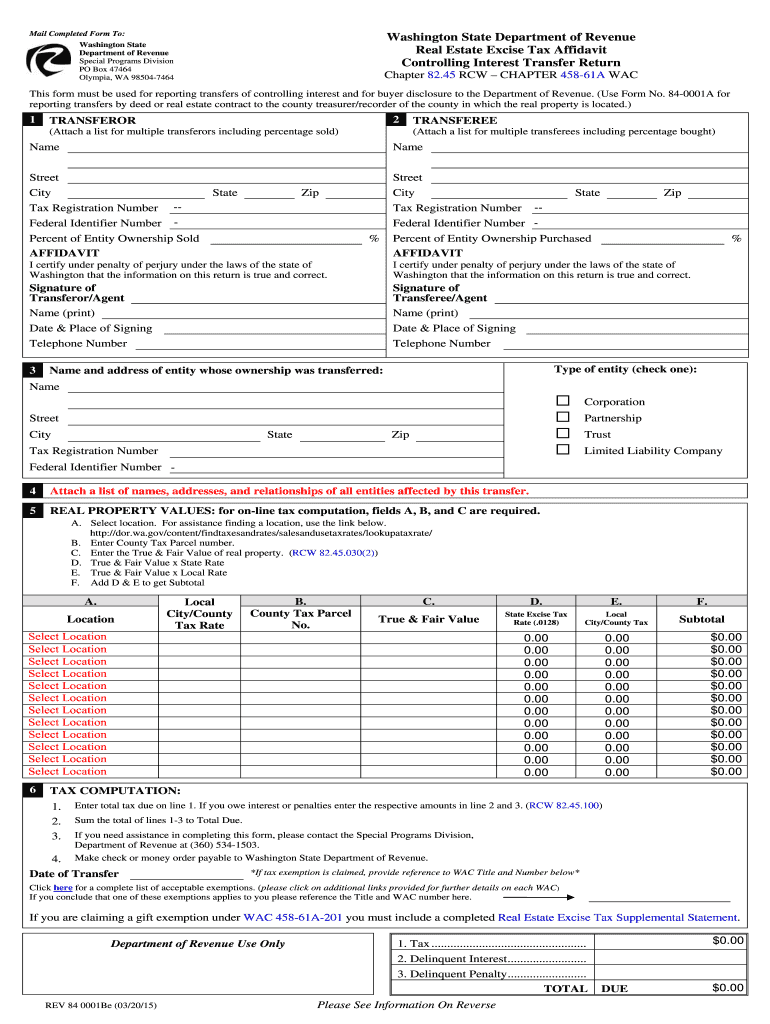

Washington estate tax forms and estate tax payment.

. Washington Department of Revenue Search Form - Mindbreeze. The types of taxes a deceased taxpayers estate can owe are. Taxpayers who are unable to timely remit payment s of amounts due should visit MyTaxDCgov to submit a request to be placed on a payment plan.

The due date of the Washington State Estate and Transfer Tax Return is nine months after the date of death. Addendum 2 - Property Used for Farming farm deduction with. An estate administrator must file the final tax return for a deceased person separate from their estate income tax return.

Please note that the IRS Notice CP 575 B that assigns an employer ID number tax ID number to the. The chart below reflects the new due dates for some tax types in response to COVID-19. If a due date falls on a Saturday Sunday or legal holiday the due date changes to the next business day RCW 112070.

Certain estates are required to report to the IRS and the recipient the estate tax value of each asset included in the gross estate within 30 days of the due date including extensions of. Addendum 1 - Qualified Terminable Interest Property QTIP or Qualified Domestic Trust QDOT with instructions. Washington estate tax return 85 0050 Ad1 62719 Schedule M Part A.

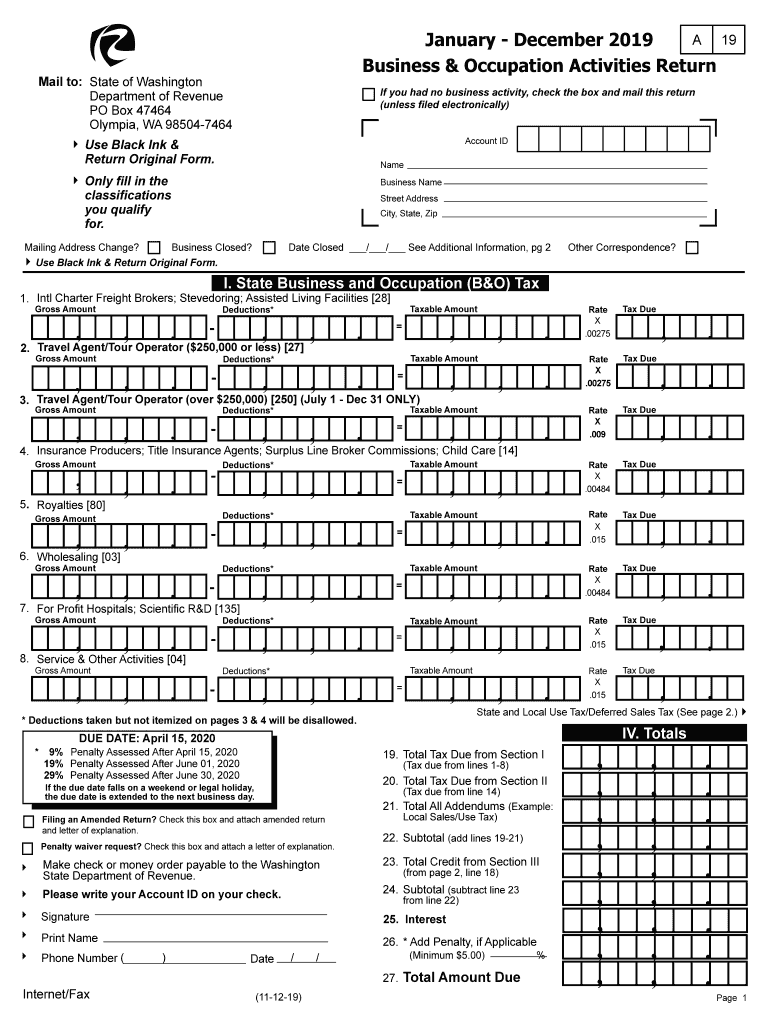

FL-2022-19 September 29 2022. Annual 2022 due date. The return is filed with the Department of Revenue Audit Division PO Box 47474 Olympia WA 98504-7474.

For returns filed on or after July 23 2017 an estate tax return is not required to be filed unless the gross estate is equal to or greater than the applicable exclusion. A request for an extension to file the Washington estate tax return and an estimated payment. The gift tax return is due on April 15th.

The Office of Tax and Revenue reminds taxpayers of important filing and payment due dates. What is the due date for the estate tax return. A timely filed extension.

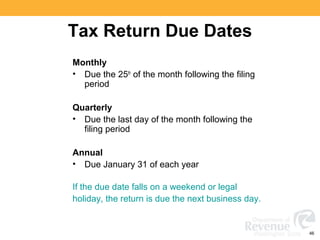

Annual due dates are listed below for the Combined Excise Tax Return. A due date alls on a Saturday Sunday or legal holiday the due date changes to. 2 Filing the state returnPayment of the tax due.

Estate tax forms rules and information are specific to the date of death. The return is due nine months after the date of death of the decedent. January All taxable real and.

2021 Property Tax Calendar. The estate tax rules for deaths occurring on or after May 17 2005 can be found in WAC 458-57-105 through 458-57-165. Penalties on payroll and excise tax deposits due date changed to October 11 2022.

A The Washington estate tax return state return must be filed with the Washington state department of revenue department if the gross estate of a decedent equals or exceeds the. WASHINGTON Victims of Hurricane. By making this election the property identified as QTIP shall be.

One of the following is due nine months after the decedents date of death. Who must file a Washington estate tax return. First estate tax return filed after the due date.

For deaths on or after Jan. Submit the Application for Extension of Time to File a Washington State Estate and Transfer Tax. 13 rows Only about one in twelve estate income tax returns are due on April 15.

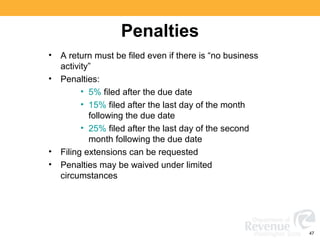

Day if less than one month to a maximum 25 of the tax due RCW 8440130. 31 rows A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. Electronic funds transfer EFT 2022.

Return extension payment due dates.

List Of State Income Tax Deadlines For 2022

Washington State Sales Use And B O Tax Workshop

Wa Dor Business Occupation Activities Return 2019 2022 Fill Out Tax Template Online Us Legal Forms

2022 Federal Tax Deadlines For Your Small Business

Washington Small Business Payroll Setup Tips Evergreen Small Business

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Cts Applicants Washington State Opportunity Scholarship

Washington State Sales Use And B O Tax Workshop

2022 State Tax Reform State Tax Relief Rebate Checks

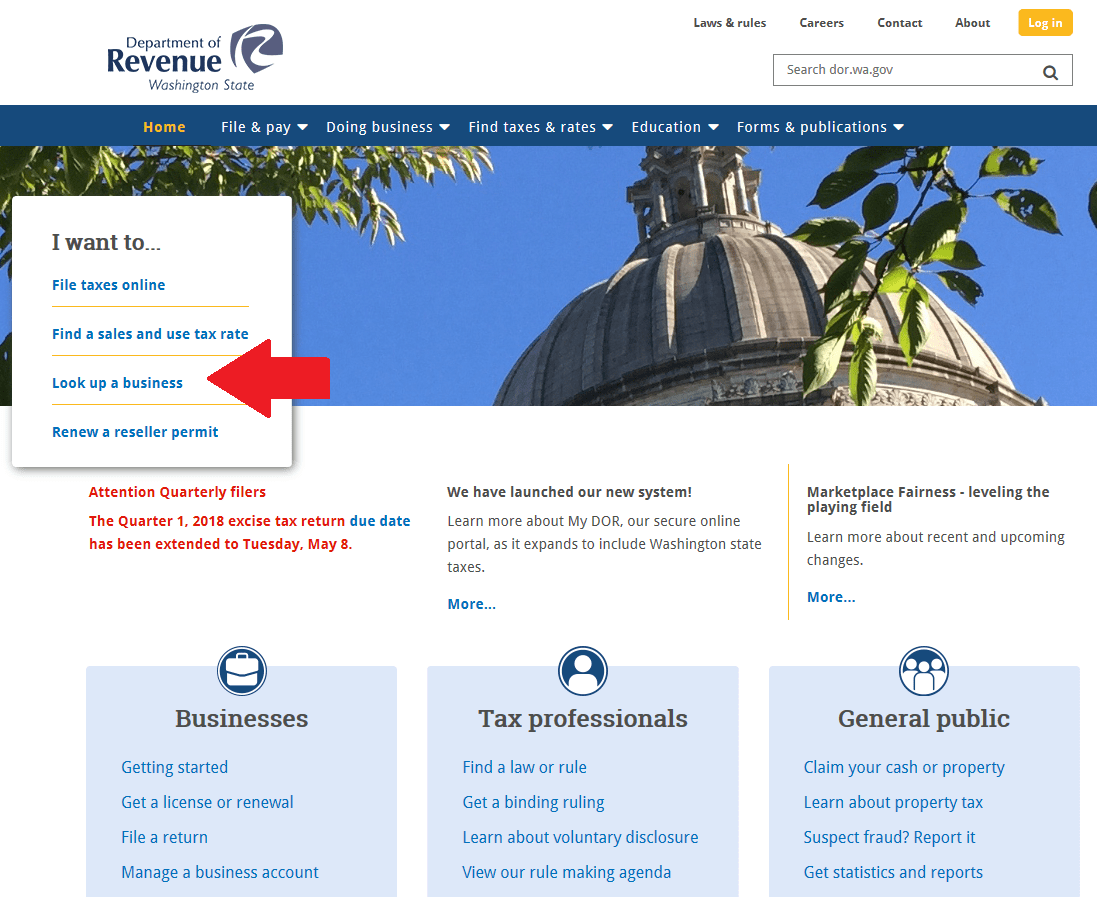

Filing Due Dates Washington Department Of Revenue

Electronic Filing Snohomish County Wa Official Website

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

International Student Tax Return And Refund

Do I Need To File A Tax Return Forbes Advisor

How Do Marijuana Taxes Work Tax Policy Center

17 States With Estate Taxes Or Inheritance Taxes

Irs Releases Tax Calendar For 2014

Washington Rev 84 0001b 2012 Form Fill Out Sign Online Dochub

Where To Mail Tax Return Irs Mailing Addresses For Each State