nebraska sales tax calculator by address

L Local Sales Tax Rate. S Nebraska State Sales Tax Rate 55 c County Sales Tax Rate.

How To Charge Your Customers The Correct Sales Tax Rates

Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information Nebraska Sales Tax Rate Finder Nebraska Department of Revenue Skip to main content.

. You can look up your local sales tax rate with TaxJars Sales Tax Calculator. Ad Find Out Sales Tax Rates For Free. New Hampshire does not impose a sales and use tax.

Secretary of State Corporate Tax Filing Corporations Domestic and Foreign Limited Liability Partnerships and Limited Liability Companies are required to submit a tax report or annual report due no later than April 15 of each required reporting year. The state sales tax rate in Nebraska is 55 and cities are permitted to add a local sales tax at rates of 05 1 15 175 or 2. Nebraskas Local Sales Tax.

Foreign and Domestic Corporations Filing LLCLLP Filings. Should you collect sales tax on shipping charges in Nebraska. Average Sales Tax With Local.

Sr Special Sales Tax Rate. Under current state law cities and counties can levy their own sales tax with voter approval and it can be set at ½ 1 1½ 1¾ or 2 percent of the retail sales within the boundaries of the city. Nebraska does address the sales and use tax treatment of virtual currency such as bitcoin.

Taxes Websites Selected by Librarians. Chronological History of Nebraska Tax Rates Tables listing current and historical tax rates including income sales local sales cigaratte motor fuels lodging. Shipping charges are taxable in Nebraska even if listed separately from the price of the item being sold.

Registration fee for farm plated truck and truck tractors is based upon the gross vehicle. This level of accuracy is important when determining sales tax rates. Groceries are exempt from the Nebraska sales tax.

Other factors that impact sales tax rates include product or service type customer type and shipping address. Nebraska collects a state income tax at a maximum marginal tax rate of spread across tax brackets. With local taxes the total sales tax rate is between 5500 and 8000.

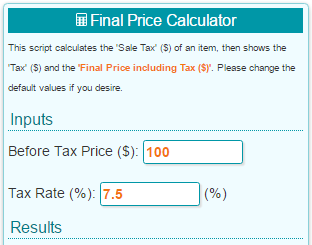

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Many Nebraska cities levy local sales taxes in addition to the state rate. Nevada does not address the sales and use tax treatment of transactions involving Bitcoin or other virtual currency.

There are no changes to local sales and use tax rates that are effective January 1 2022. Select the Nebraska city from the list of popular cities below to. Frequently Asked Questions about Nebraska Business Income Taxes from the Nebraska Department of Revenue.

The Registration Fees are assessed. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. The sales tax rate provided is an estimate based solely on the address entered into the sales tax calculator.

Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2. 31 rows The state sales tax rate in Nebraska is 5500. 1500 - Registration fee for passenger and leased vehicles.

When you enter the street address the calculator uses geolocation to pinpoint the exact tax jurisdiction. There are a total of 295 local tax jurisdictions across. Nebraska has a state sales and use tax rate of 55.

Nebraska provides no tax breaks for Social Security benefits and military pensions while real estate is assessed at 100 market value. The Nebraska state sales and use tax rate is 55 055. TOTAL ESTIMATED TAX RATE.

From there it can determine the corresponding sales tax rate by accessing AvaTax our innovative cloud-based sales tax calculation product. You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt. Like the Federal Income Tax Nebraskas income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. The Nebraska Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Nebraska in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Nebraska.

Effective April 1 2022 the city of Arapahoe will increase its rate from 1 to 15. Nebraska has recent rate changes Thu Jul 01 2021. ArcGIS Web Application - Nebraska.

Registration fee for commercial truck and truck tractors is based upon the gross vehicle weight of the vehicle. Nebraska Sales Tax Calculator. So whilst the Sales Tax Rate in Nebraska is 55 you can actually pay anywhere between 55 and 75 depending on the local.

Nebraskas maximum marginal income tax rate is the 1st highest in the United States ranking directly. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 75. The Nebraska NE state sales tax rate is currently 55.

535 rows Nebraska Sales Tax. Fast Easy Tax Solutions. There are no changes to local sales and use tax rates that are effective July 1 2022.

Counties can also add a 05 option sales tax but that rate will only be applicable in areas that are not already covered by a local city tax.

Car Tax By State Usa Manual Car Sales Tax Calculator

States With Highest And Lowest Sales Tax Rates

Nebraska Sales Tax Small Business Guide Truic

Item Price 34 99 Tax Rate 8 Sales Tax Calculator

Understanding California S Sales Tax

Indiana Sales Tax Calculator Reverse Sales Dremployee

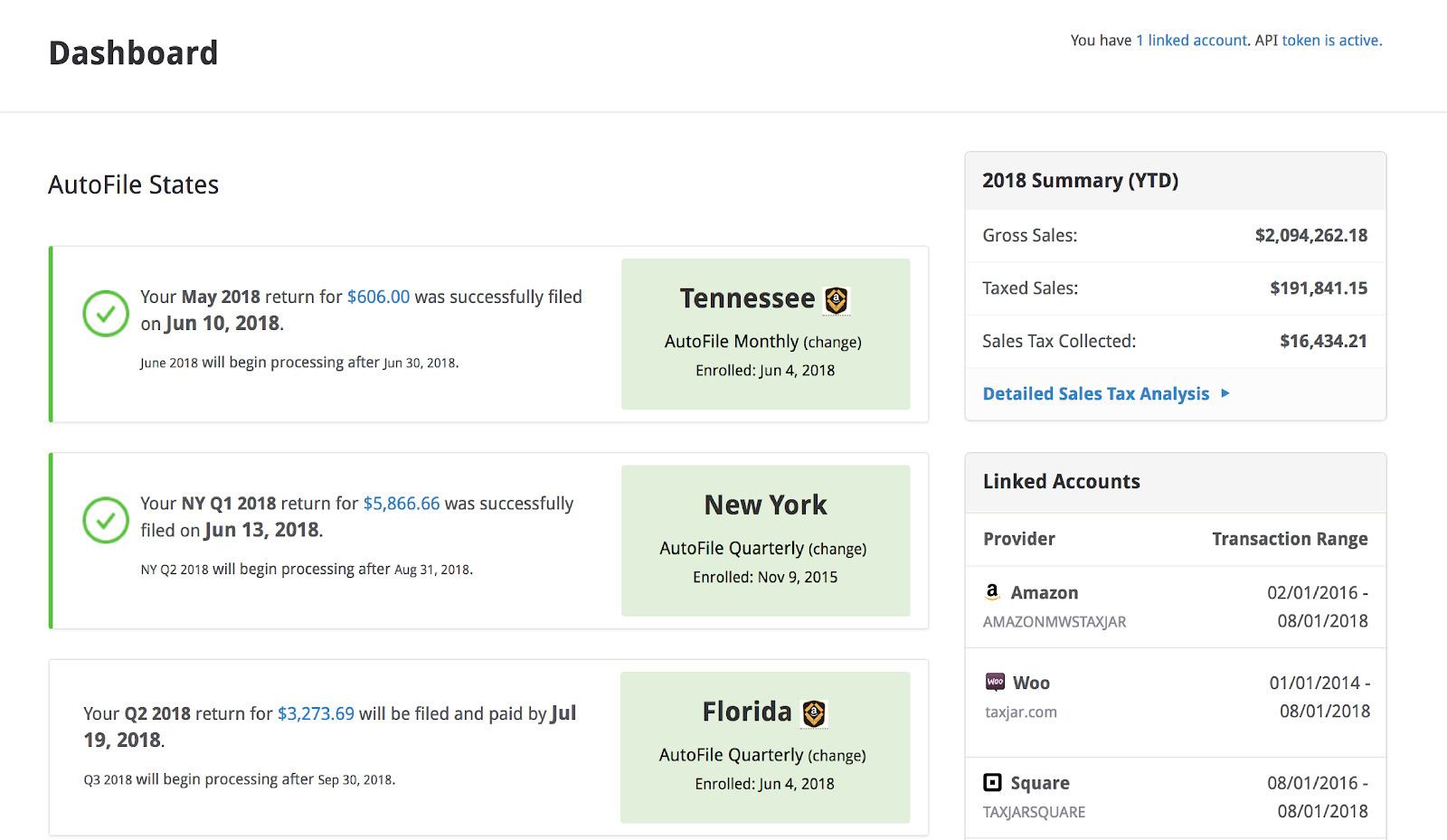

Woocommerce Sales Tax In The Us How To Automate Calculations

Sales Taxes In The United States Wikiwand

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

Transfer Tax Calculator 2022 For All 50 States

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)